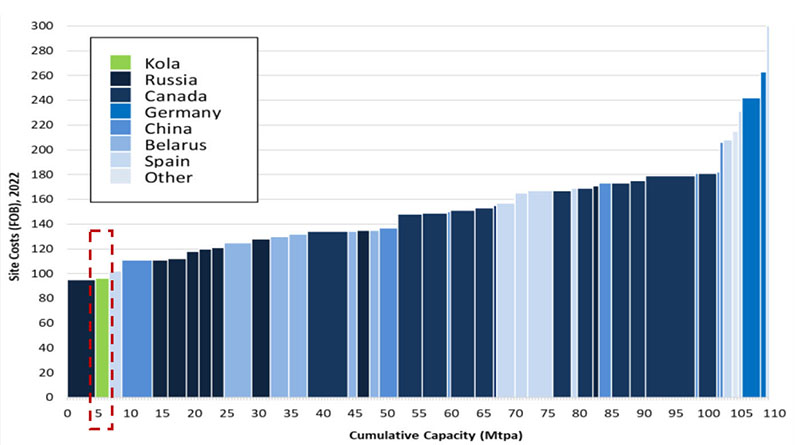

Low cost production

Very low cost of supply into target markets

Kore has the potential to be:

- The lowest cost supplier to its target markets

- The second lowest cost producer (Kola project) of MoP on an export cost basis at US$86.61/t FOB (real 2019)

- The DX project is expected to supply potash to African markets at a cost of US$114.61/t CFR (real 2019)

- Ability to compete on price against all existing suppliers in our selected growing markets

- Increasingly competitive in scenarios where global land transport and shipping costs increase

- Significantly more environmentally sustainable than other potash projects, due to low operational costs and shorter transport distances to end users

Source: CRU Potassium Chloride Market Study August 2018

1. Kola FOB and CFR delivered costs used in the cost curves are on a real 2018 basis escalated to 2022

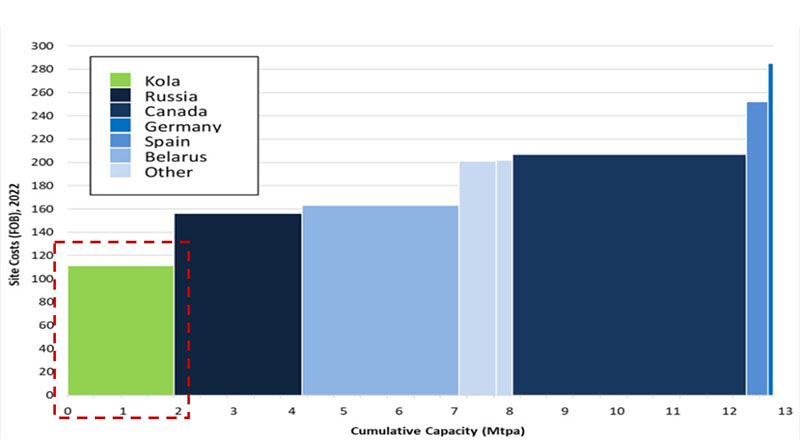

Comparison with other projects

The large Potash deposits in the Sintoukola basin have potential to produce potash for multiple generations.

DX is a low capital cost, low operating cost project

- Ore Reserves of 17.7 Mt at a grade of 41.7 % KCl make this one of the highest grade potash projects globally

Kola is amongst the shallowest MoP projects globally

- Shaft bottom 270m below surface

- Significant opex and capex advantage

Kola, like DX, is one of the highest grade undeveloped potash deposit globally

- Only 1-2 other peers come close to Kola but both well over 1,000m deep

- Grade a key driver of high operating margins in potash mining